Charlie Munger once turned to his longtime business partner Warren Buffett and said, “Warren, if people weren’t wrong so often, we wouldn’t be so rich!”

Charlie’s message has resonated with me for many years. It’s a big reason why I spend so much time focused on where people are the most wrong.

It’s not about being smarter than everyone else. It’s just about being a little less stupid.

That goes a long way, let me tell you, and it most definitely compounds over time.

Charlie’s quote inspired the name of this e-letter.

And I really appreciate you reading Everybody’s Wrong, by the way.

The feedback has been amazing. So thank you!

Where Are They Wrong Today?

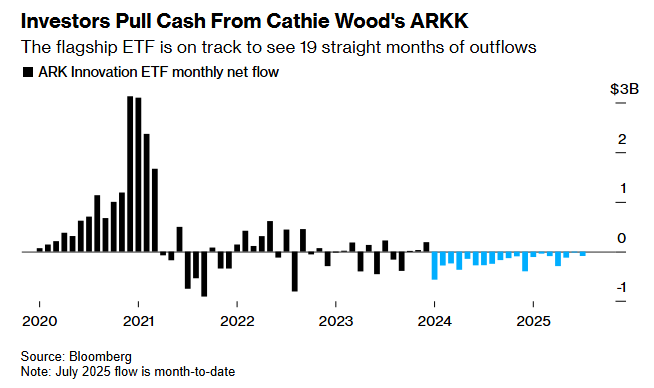

This recent chart from Bloomberg shows the monthly net flows into Cathie Wood’s flagship fund, the ARK Innovation ETF (ARKK):

ARKK holds a basket of speculative, high-growth stocks.

As we can see, the fund is on track for 19 consecutive months of net outflows.

Money continues to leave this type of strategy… at the most aggressive rate of all time.

They’re Betting Against It Too

Despite the epic outflow, ARKK still has more than $6 billion in assets under management. And that’s just this one ETF.

ARKK includes names such as Tesla (TSLA), Coinbase Global (COIN), Roblox (RBLX), Palantir Technologies (PLTR), Robinhood Markets (HOOD), and Archer Aviation (ACHR) as well as stocks in Crypto, Technology, Fintech and other speculative growth sectors and industries.

But here’s the thing.

It’s not like they’re just NOT buying the ETF.

They’re betting against it at the most aggressive rate of all time.

Look at the short Interest in the ETF – it’s now above 30% of the outstanding shares:

Remember, if you own a stock or an ETF, you’re only promising to be a future seller.

However, if you’re short the stock or ETF, you’re a guaranteed future buyer.

Buying shares is the only way to unwind a short position.

Keep in mind that there has never been this many guaranteed future buyers in this ETF ever before.

And the best part of all the money flowing out of the ETF – and all the shorts piling in at record levels betting that prices will fall – is that the ETF itself is hitting new multi-year highs:

Investors who don’t own this ETF, and the stocks that are in it, now have to buy it in order to keep up.

Shorts are losing money as price goes up, so they have to buy it in order to stop the bleeding.

There are a lot of potential buyers out there, and that’s on top of the natural buying pressure we’re already seeing.

We’re long some of the major components of the ARKK ETF, and we continue to look for more “speculative growth” exposure.

These names are working. People keep betting against them.

And that’s exactly what we’re here to take advantage of.

Everybody’s wrong.

Stay sharp,

JC Parets, CMT

Founder, TrendLabs