Historically, when everybody expects stocks to rise and consumers are also feeling good, it doesn’t bode well for the market.

At a certain point, if we’re all bullish, and we’ve all acted upon that belief, who’s left to buy?

And that’s when stock prices fall.

Now, flip that on its head.

Everybody is waiting for a crash, and consumers feel terrible.

At a certain point, if we’re all bearish, and we’ve all taken cover, who’s left to sell?

And that’s when stock prices rise.

Asset prices do not move based on fundamentals. We know this to be true.

We have the math; see Valuations Don’t Matter.

Asset prices move based on positioning – or mispositioning, I should say, in many cases.

Bring on deGraaf

For those of you who are just getting to know me, welcome.

It’s going to be a fun ride!

I have a personal Mount Rushmore of Technicians who have helped and/or inspired me to build the framework for my approach to markets you see here today, in my 23rd year trading the markets.

Jeff deGraaf is definitely up there. Jeff is Chairman and Head of Technical Research at Renaissance Macro, an institutional research firm.

Before that, he spent a lot of time at Merrill Lynch and was a Managing Director at Lehman Brothers.

When Jeff speaks, we listen.

Here’s what Jeff said when asked about current market sentiment:

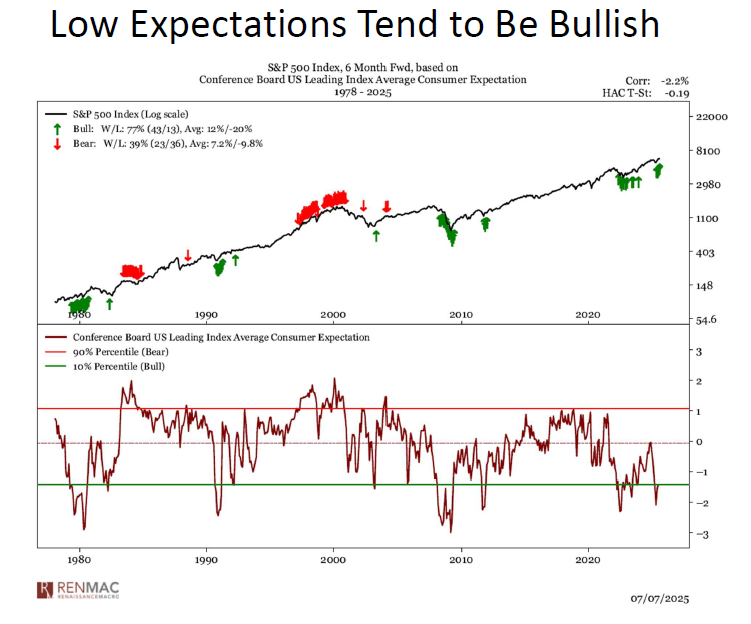

One of our favorite things to do is look at what expectations are from a consumer standpoint. And as counter intuitive as it may be, low consumer expectations actually result in higher equity prices historically…

I don’t think there’s too much complacency. I certainly don’t think there’s too much speculation or over exuberance.

This is one of the best who ever did it, reiterating what we’re seeing from our end as well.

Investors are not buying into this rally. They’re waiting for a pullback, and they’re not getting it.

Investors who got scared out of the market this spring haven’t come back, and it’s a problem for them.

We have the data. We know. We see it.

Here’s a chart Jeff shared showing the Conference Board U.S. Leading Index Average Consumer Expectations:

Historically, we don’t see this index near the 10th percentile.

These are times when we want to be buying stocks.

We have the data. We know.

And so we’re acting accordingly. We’re buying stocks.

ETF flows into stocks have been weak.

Asset managers and hedge funds are massively underweight and falling behind their benchmark indexes.

And short interest is still super high, not just at the median stock level, but especially in certain pockets of the market, such as speculative growth stocks, biotech, regional banks, oil and gas and transportation stocks.

They don’t believe in the rally.

And, as it turns out, that’s perfectly consistent with the early stages of a powerful rally.

Only Price Pays

Here at TrendLabs we always talk about how price is the only thing that pays.

In other words, the only way we make a buck around here is by selling things at higher prices than where we buy them.

And understanding that concept is a prerequisite for success.

However, in addition to price being what pays us, the driver of those prices is the sentiment.

Sentiment is what makes prices move. It’s not the fundamentals.

New highs in stocks with new highs in short interest is a great combination.

New highs in stocks with low consumer expectations is a great combination.

In the current market environment, we have all of the above.

Everybody’s wrong.

And the market keeps proving it.

Stay sharp,

JC Parets, CMT

Founder, TrendLabs