Founder’s Note: Geopolitics is not my thing. In fact, I hate it. But it is part of our reality. Our man Jason Perz does not hate geopolitics. He embraces it all. And I appreciate him for that.

Jason has some insightful observations about what’s happening in the Middle East. And he has some ideas about how it’ll impact key sectors of the market. Here’s Jason. – JC

By Jason Perz

This isn’t noise.

It’s the sound of history accelerating.

You can feel it in the headlines.

Explosions near a military airbase west of Tehran. Iranian officials are scrambling. Israeli jets in the air again.

This isn’t a drill. This isn’t a skirmish. It’s escalating.

Netanyahu says the mission is clear: Crush Iran’s nuclear program.

Tehran says the opposite: We’re just getting started.

No one’s bluffing.

No one’s backing down.

The Escalation Trade

According to Iran’s Atomic Energy Organization, Israel hit the Natanz nuclear site.

Iran says the damage was superficial. No casualties. No radiation leaks.

But unofficial sources?

They’re reporting 70 dead, 300 injured, and a military leadership structure that’s been decapitated.

This wasn’t symbolic.

This was surgical.

Tehran. Natanz. Tabriz. Isfahan. Arak. Kermanshah.

Each city hit. Each site chosen. Not for shock – but for strategy.

Israel didn’t just drop bombs. They played chess.

They lured Iran’s top brass into a bunker. And made sure they didn’t leave.

They used drones, sabotage, misinformation – and timing.

And then?

They flipped the switch.

This isn’t just a military operation. It’s the death of diplomacy – at least for now.

The next round of U.S.-Iran nuclear talks? Gone. Vaporized.

Retaliation is a matter of when, not if.

Iran’s new Islamic Revolutionary Guard Corps leadership is already in place.

Ali Hosseini Khamenei isn’t mincing words. He’s promising “bitter and painful” consequences.

This is the kind of moment that rewrites alliances, re-prices assets, and reshuffles everything you thought was stable.

And if you’re still asking who’s right or wrong – you’ve already missed the trade.

This is about momentum, and we continue to follow it into stocks, crypto, commodities, and the energy sector.

Energy: Where the Real Strength Lives

When things break geopolitically, capital seeks shelter.

When it floods, capital seeks strength.

And, right now, that strength is in commodities. More specifically, it’s in energy.

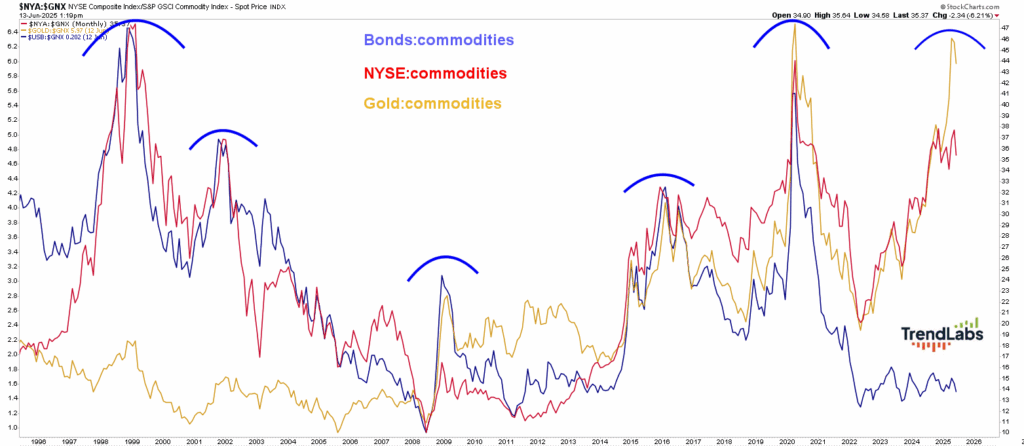

Look at the chart: Money is flowing out of bonds and stocks vs. commodities.

Look at the red line: Stocks vs commodities haven’t made a new high since November 2024.

That’s your clue.

When equities lag this long, it means one thing: Commodities are in control.

And history tells us these cycles don’t reverse quickly.

They build.

They accelerate.

They surprise.

This could be the start of a major trend in crude oil, uranium, and commodity stocks.

The signals are stacking. The momentum is building.

The only question is…

Are you positioned for it?

Save the bees,

Jason Perz

Senior Analyst, TrendLabs