Crude Oil and Energy stocks are ripping higher this week.

In the news, they might tell you it’s because of a war somewhere, or some kind of turmoil in the Middle East.

As usual, I think everybody’s wrong.

Some kind of war? That’s an always thing.

Turmoil in the Middle East? What else is new?

Let’s talk about what’s actually happening.

Make Friends With This Trend

When it comes to the market, there’s a lot we as investors just don’t know.

So, one of the things I really like to do is to start with the things we do know.

First of all, asset prices trend.

When an asset is rising in price, there is a much higher likelihood the asset will continue to rise in price rather than completely reversing and heading in the opposite direction.

We know this. We have the data. It’s just math.

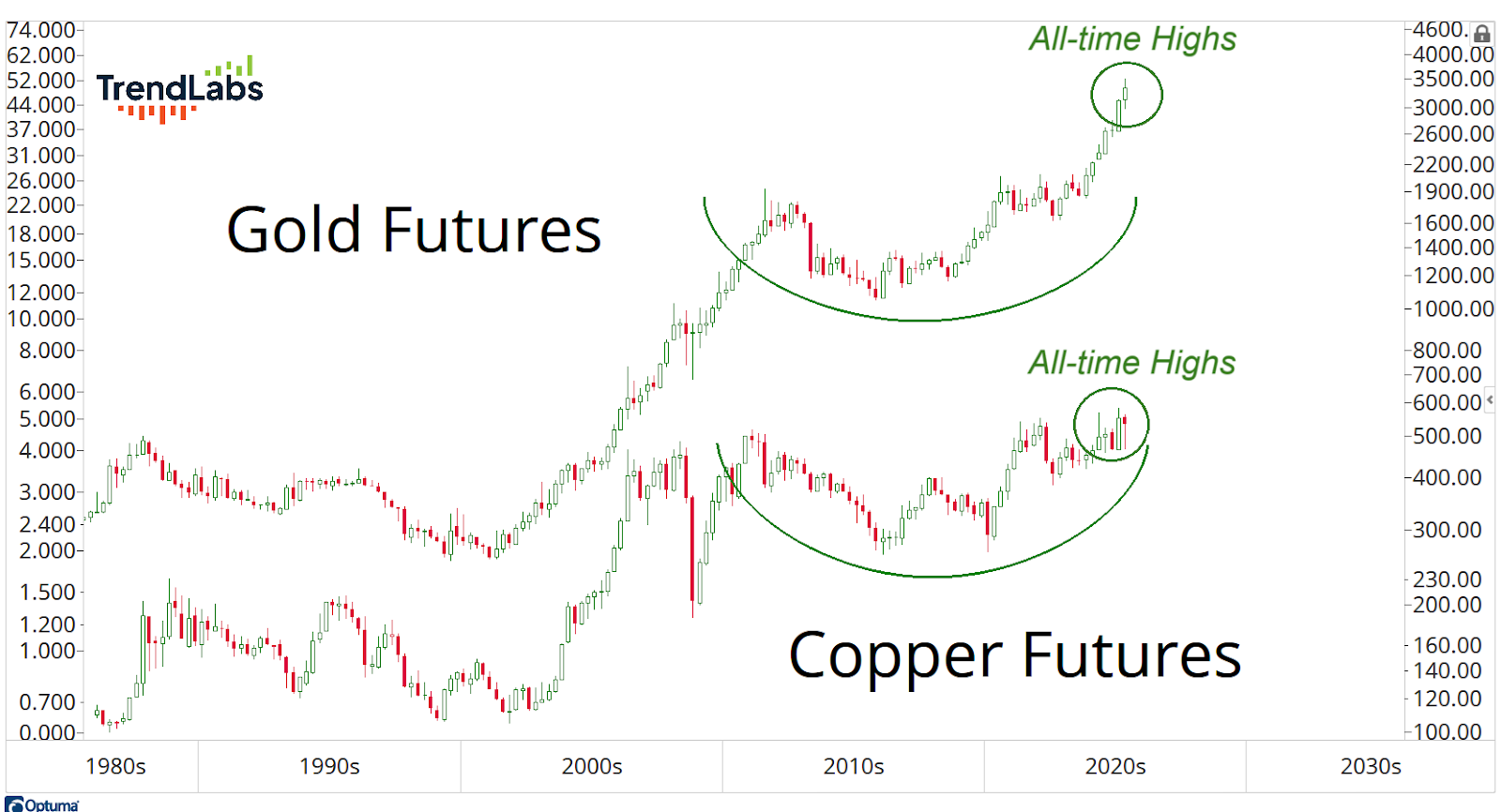

Here’s something else that we know: Commodity Supercyles don’t last for just a couple of years. They last for decades.

The first one to go is Gold.

Gold was breaking out to new all-time highs when priced in every currency in the world.

Last year, prices finally broke out in U.S. Dollar terms, and we’ve been seeing new all-time highs every single quarter since.

But don’t miss Copper hitting new all-time highs this year as well:

First Gold moves. Then Copper goes.

Which major Commodity and contributor to the Supercycle is next?

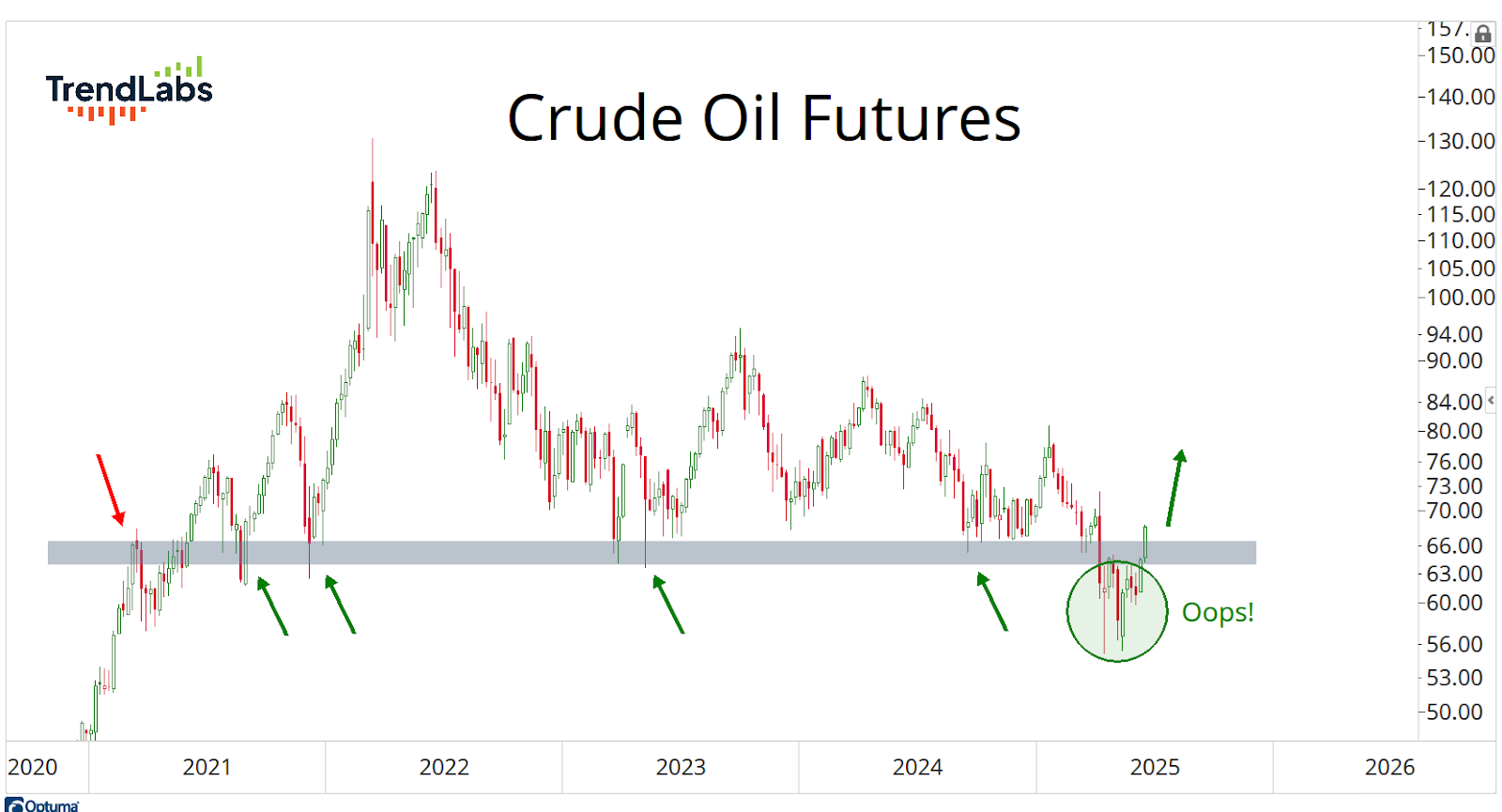

Crude Oil.

With historic short positions in Oil & Gas Services and Oil & Gas Exploration & Production, should we be surprised short sellers are getting squeezed?

It’s nasty out there. And they deserve everything they have coming to them.

Short sellers in Energy overstayed their welcome.

And now they’re suffering the consequences.

Americans Don’t Own Energy

One thing I really like about this Energy trade is Americans simply don’t own it.

That’s why we’ve been increasing our Energy exposure over the past few weeks, buying more Energy stocks, and options.

We know the short-sellers have been all over this.

But let’s put aside those “sophisticated” investors for a minute.

Your everyday regular American investor simply does not own Energy.

And when we find vulnerabilities like this, we want to take advantage.

Remember, it’s not our problem that all these Americans own way too much Technology and don’t own any Energy.

The question we want to ask is, what would hurt the American investor the most? What would cause the most pain?

Because that’s where we want to be.

In my estimation, it’s in Energy.

Investors who own the S&P 500 are only getting 3% exposure to Energy, near a historic low weighting for this benchmark index.

Investors who own the Dow Jones Industrial Average are actually getting less than 2% Energy.

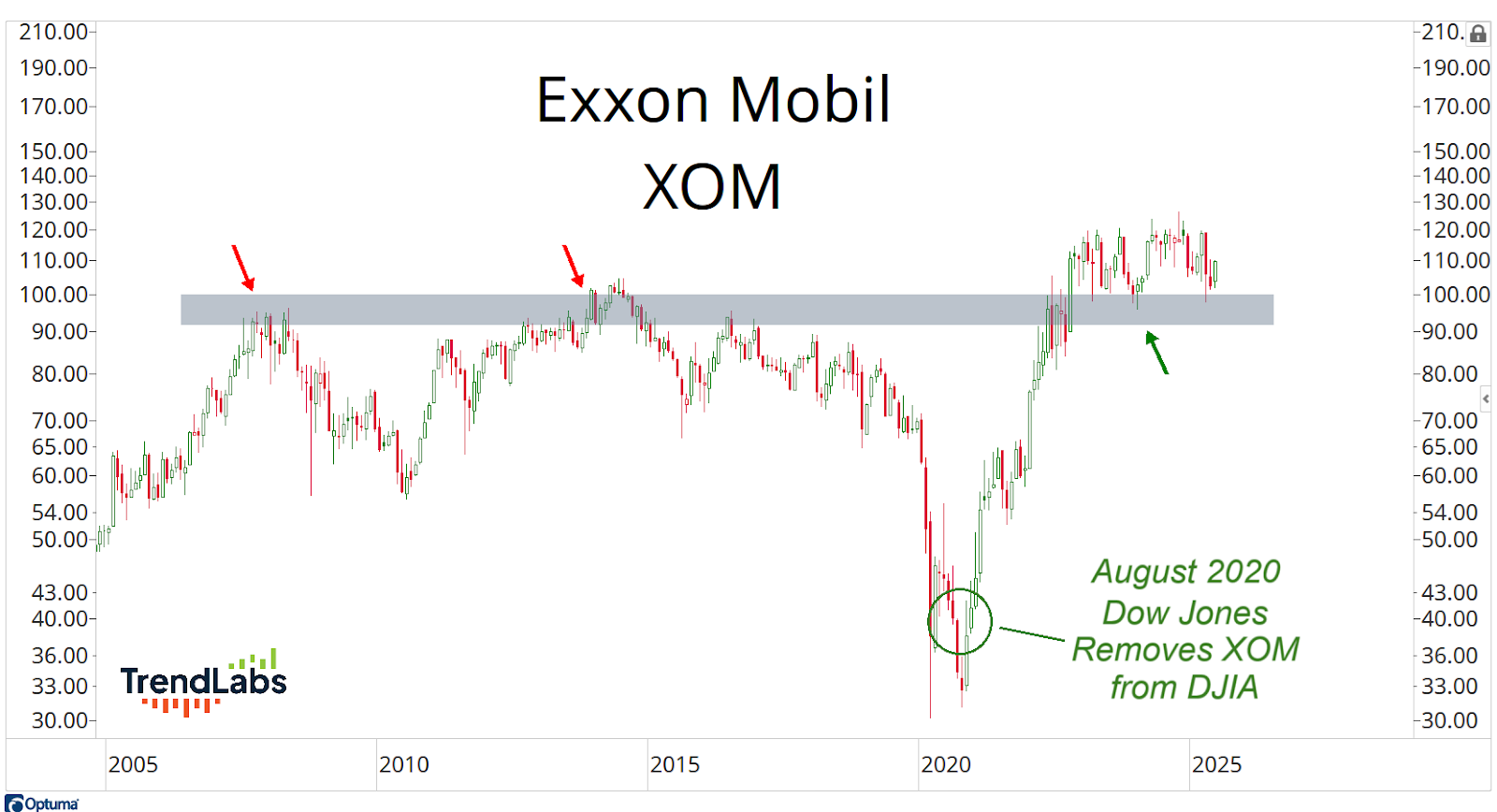

Remember, they kicked Exxon Mobil (XOM) out of the Dow a few years ago, just before the stock went on to triple in price.

And I think this move is just getting started.

And if investors own the Nasdaq100 through the $QQQ ETF, which many do, they have 0% exposure to Energy.

Investors are vulnerable.

The worst thing that could happen to them is a spike in Oil prices and a historic rally in Energy stocks.

So that’s what we’re betting on.

Stay sharp,

JC Parets, CMT

Founder, TrendLabs