Bitcoin and Cryptocurrency are not a new asset class.

They’re just more technology stocks.

Everybody’s wrong about this.

And they’ve held themselves back by putting Bitcoin and Crypto on a pedestal.

My Personal Evolution

I started trading Crypto back in 2013 when I was given Bitcoin by a founder and CEO of a startup whom I met through mutual friends.

But it wasn’t until 2015 that I started including Bitcoin in my chartbooks.

Funny thing, looking back, I actually included it with all my other currency charts, like the US Dollar, the Euro, and the Japanese Yen.

I assumed, because they were called “Cryptocurrencies,” they should be treated as currencies.

That’s how little I knew. And I was wrong.

But, hey, at least I was there. At least I was trying.

I’d changed my mind by the time the 2017 Crypto rally got started.

Names like Ethereum (ETH) and Ripple (XRP) were making big moves as well, so it was no longer just Bitcoin.

It was a whole new asset class… or so I thought.

And I was wrong… again.

It took me a few cycles to finally come to the realization that these things are not a separate asset class at all.

They are not Currencies. They are not Commodities.

They are not some new thing.

They are just stocks.

For a while you had to open an account separate from your old-school brokerage account to trade them. That’s changing.

But inconvenience is no reason to treat them as a separate asset class.

It wasn’t until about 2020 or so that I finally realized the truth.

When we talk about Cryptocurrencies or “Tokens” or “Coins,” we’re talking about the same things.

These are different words to describe code that can be traded onchain.

(That’s another thing: “Onchain” is now one word. See how I evolve with the times? It’s tough to keep up sometimes, but I’m here for you!)

And these Cryptocurrencies are just stocks. They are Technology stocks.

Within Technology you have different industry groups such as Hardware, Semiconductors, Software, Cloud Computing, Electronics, and more.

Crypto is just one of those. With a total aggregate value of about $3.5 trillion, it’s not the largest subsector, nor is it the smallest.

It’s just another Tech subsector, no big deal.

Each Tech subsector has its bellwethers – think Nvidia (NVDA) for Semis, Microsoft (MSFT) for Software.

Bitcoin is the bellwether for Crypto.

Turning to the Data

I kind of wish Crypto was its own asset class.

I wish Bitcoin and other Cryptos didn’t move with stocks.

I would love nothing more than to add an additional uncorrelated asset class to my arsenal, like we have with Commodities and Bonds and Forex.

I wish we did. But we don’t.

Cryptos are just more stocks.

They are high-beta stocks – they tend to move more than lower-volatility stocks.

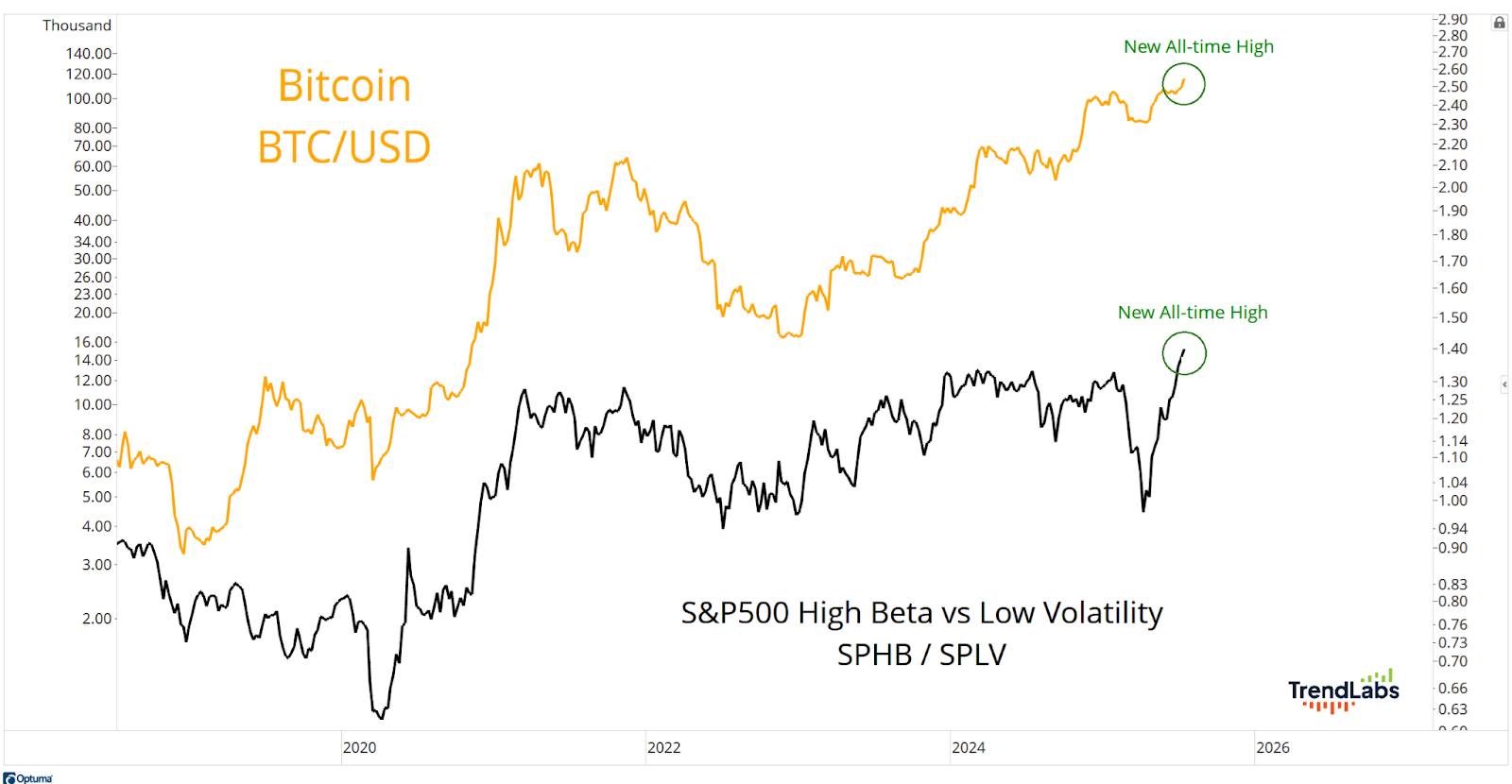

Here’s a chart of Bitcoin hitting new all-time highs after a multi-year consolidation starting in late 2021 following the post-COVID rally:

Notice how the ratio of S&P 500 High Beta vs Low Volatility (the black line) did the exact same thing through this entire period.

The black line rallied after COVID, stopped rising in 2021, then consolidated for a few years.

Now it’s hitting new all-time highs… just like Bitcoin!

I encourage you to look at the stocks within the S&P 500 High Beta Index.

You’ll find a lot of Technology and plenty of Consumer Discretionary stocks.

You won’t find much Real Estate or Consumer Staples. Those are the types of things you’ll find in the Low Volatility Index.

High Beta includes stocks such as Tesla (TSLA), Super Micro Computer (SMCI), Palantir Technologies (PLTR), Micron Technology (MU) and, of course, Nvidia.

When you overlay a chart of Bitcoin, they look a lot like it.

That’s because Cryptos are Tech stocks.

I was wrong about that 12 years ago. I was still wrong about that 10 years ago. But I smartened up.

Most people haven’t gotten there yet. They’re still wrong.

Cryptos are just more stocks. Let’s treat them that way until they prove otherwise.

And they’re going up… just like stocks.

Stay sharp,

JC Parets, CMT

Founder, TrendLabs