We said it a month ago – and now we’re saying it louder.

Bitcoin Dominance has likely peaked.

The rotation has already started. That means “Altseason” is underway.

This is when all the “alternative” Cryptocurrencies outperform the behemoth that is Bitcoin (BTC).

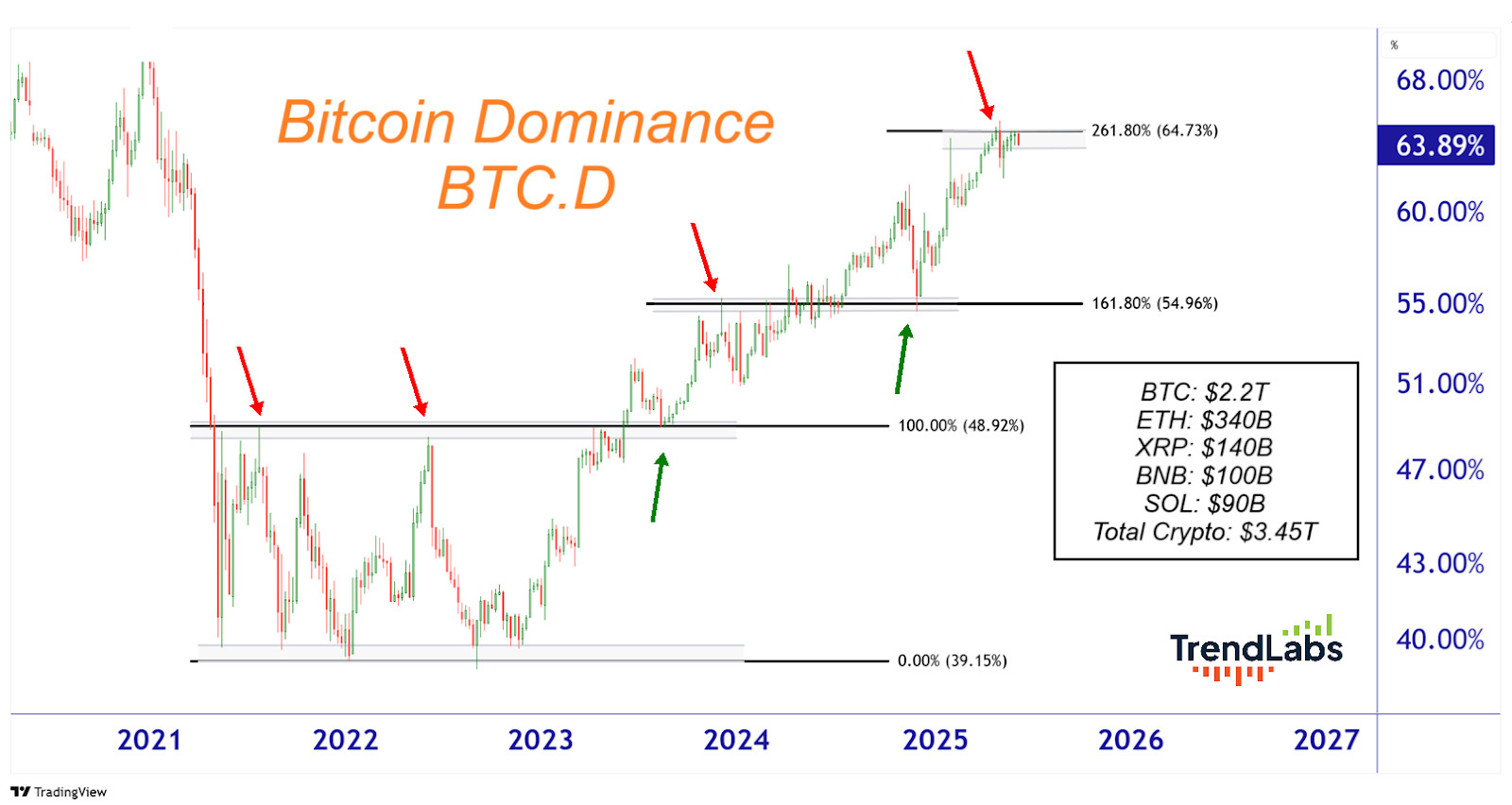

Here’s a chart of Bitcoin Dominance:

This represents the total value of Bitcoin as a percentage of total Crypto market capitalization.

The total Crypto market cap right now is only $3.45 trillion. This is the value of all the Cryptocurrencies around the world combined.

For perspective, both Microsoft (MSFT) and Nvidia (NVDA) are each worth more than all of Crypto. Both of these stocks carry market caps close to $3.5 trillion.

Bitcoin right now is just under $2.2 trillion, which puts current Bitcoin Dominance near 64%.

I still believe there’s an above-average chance that Bitcoin Dominance has peaked forever.

We may never see Bitcoin represent such a large share of the crypto market again.

If I’m right, the rotation into altcoins will be epic.

And no one believes it’s coming.

Bitcoin Dominance Is Over

I’m sure you’ll be shocked to hear that I believe everybody’s wrong.

I think Ethereum (ETH) could have a market cap of $1 trillion this cycle. It’s currently around $340 billion.

Ethereum is the key component right now. It’s the only one that can really eat into that Crypto market-cap pie.

ETH is larger than the next three tokens COMBINED: Ripple (XRP, $140 billion), Binance (BNB, $100 billion), and Solana (SOL, $90 billion).

If I’m right and Bitcoin Dominance has peaked, this is likely the last cycle where the only thing that can actually make an impact is the performance between ETH and BTC.

Tokens like Ripple perhaps, or even Binance, Solana, and Sui (SUI, $11 billion) – or others we may not have even heard of yet – could also take market share from Bitcoin.

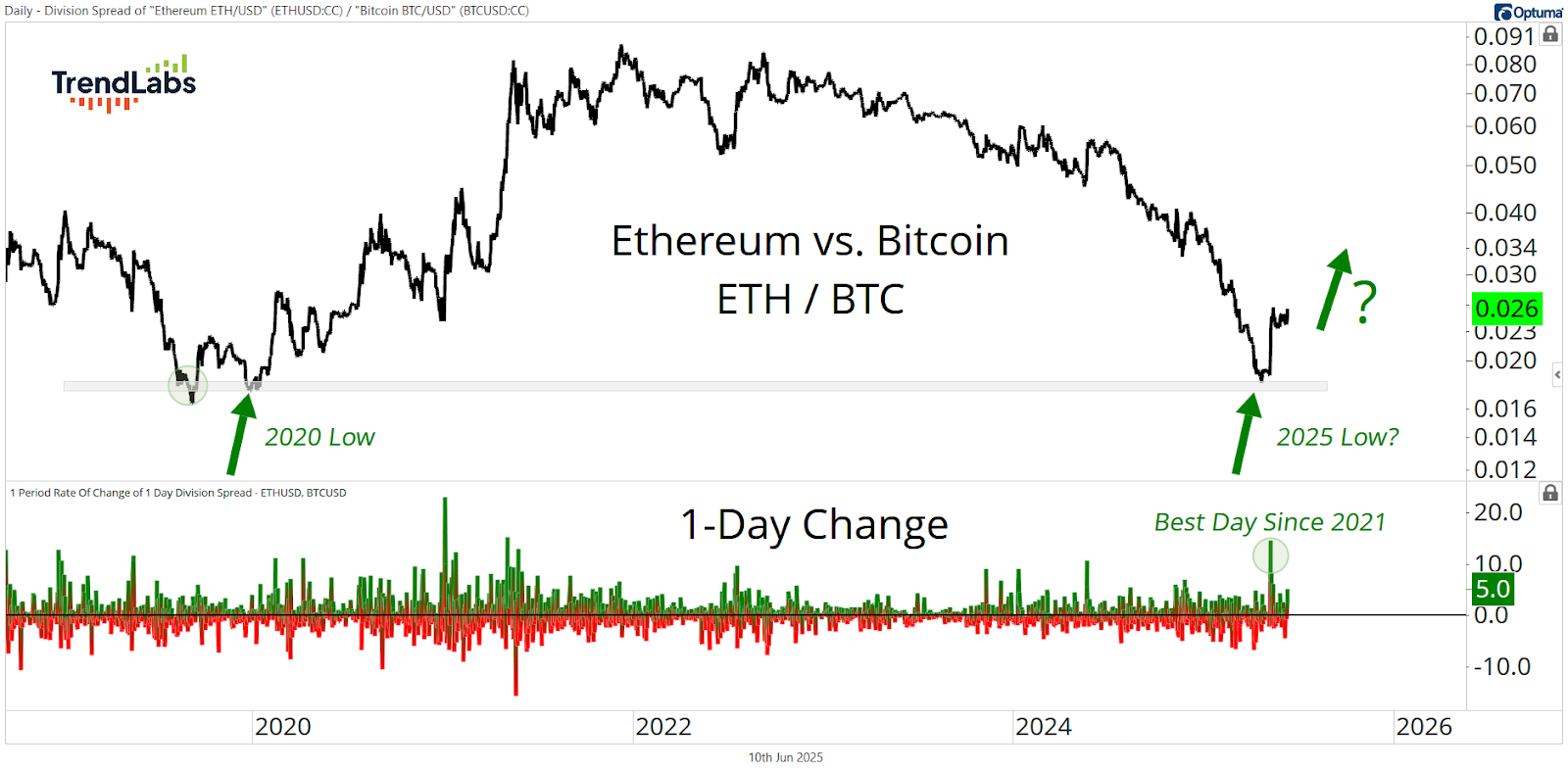

Check out this momentum thrust in the ETH vs BTC ratio:

Last month, ETH surged relative to BTC with its biggest one-day move since 2021.

These kinds of “momentum thrusts” occur consistently near the beginning of new trends.

They are NOT evidence of exhaustion. They historically signal initiation.

Also, this change in trend happened right where the ratio bottomed back in 2020.

Do you really believe that’s a coincidence? I do not.

It’s just a classic example of prior support continuing to act as support.

There’s more demand for ETH at these prices relative to BTC. That was the case five years ago, and it’s the case again today.

Since the big move, there has been upside follow-through, followed by a textbook consolidation.

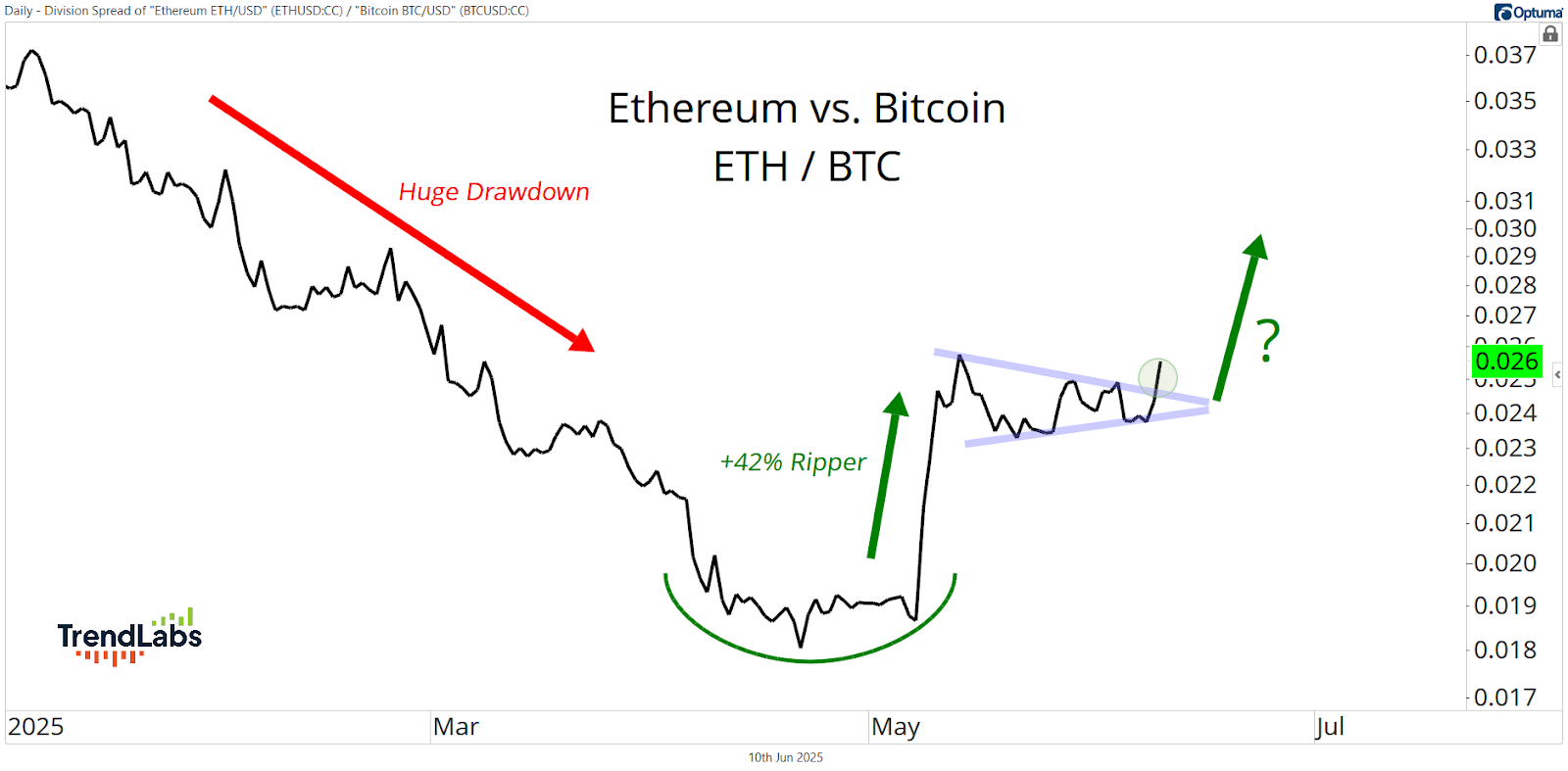

Here’s a closer look at the ratio:

Here you can see the 42% ripper off the lows in ETH relative to BTC.

In a well-deserved digestion of gains, the ratio carved out a textbook continuation pattern.

And it’s gearing up for the next leg higher right now.

I think this ratio will continue grinding higher for the foreseeable future.

Ethereum to a Trillion

The best part? Everybody’s wrong about Ethereum.

Nobody thinks Bitcoin Dominance has peaked.

Good.

Think about the implications here of ETH to $1 trillion and Total Crypto up towards $5 trillion to $6 trillion.

Crypto mining stocks are probably flying.

Think Mara Holdings (MARA), Riot Blockchain (RIOT), Hut 8 (HUT), Core Scientific (CORZ), and what feels like more of them every day.

Names like Coinbase (COIN), Strategy (MSTR), and anything else Crypto-related are most likely doing great.

And let’s remember, Technology in general is probably doing very well if Crypto is ripping and Altcoin season has begun.

We don’t put Cryptocurrencies on a pedestal. I look at this group like just another industry group within the larger Tech sector.

These are not “alternatives” to stocks, such as Gold or Bonds.

These are just more Tech stocks, no matter what they tell you.

So let’s remember to treat them that way.

Stay sharp,

JC Parets, CMT

Founder, TrendLabs